More Millionaires On The Way… Are You Going To Be One Of ‘Em?

Hey, I came across an interesting article that I wanted to share with ya from CNN Money called “The Coming Millionaire Boom.”

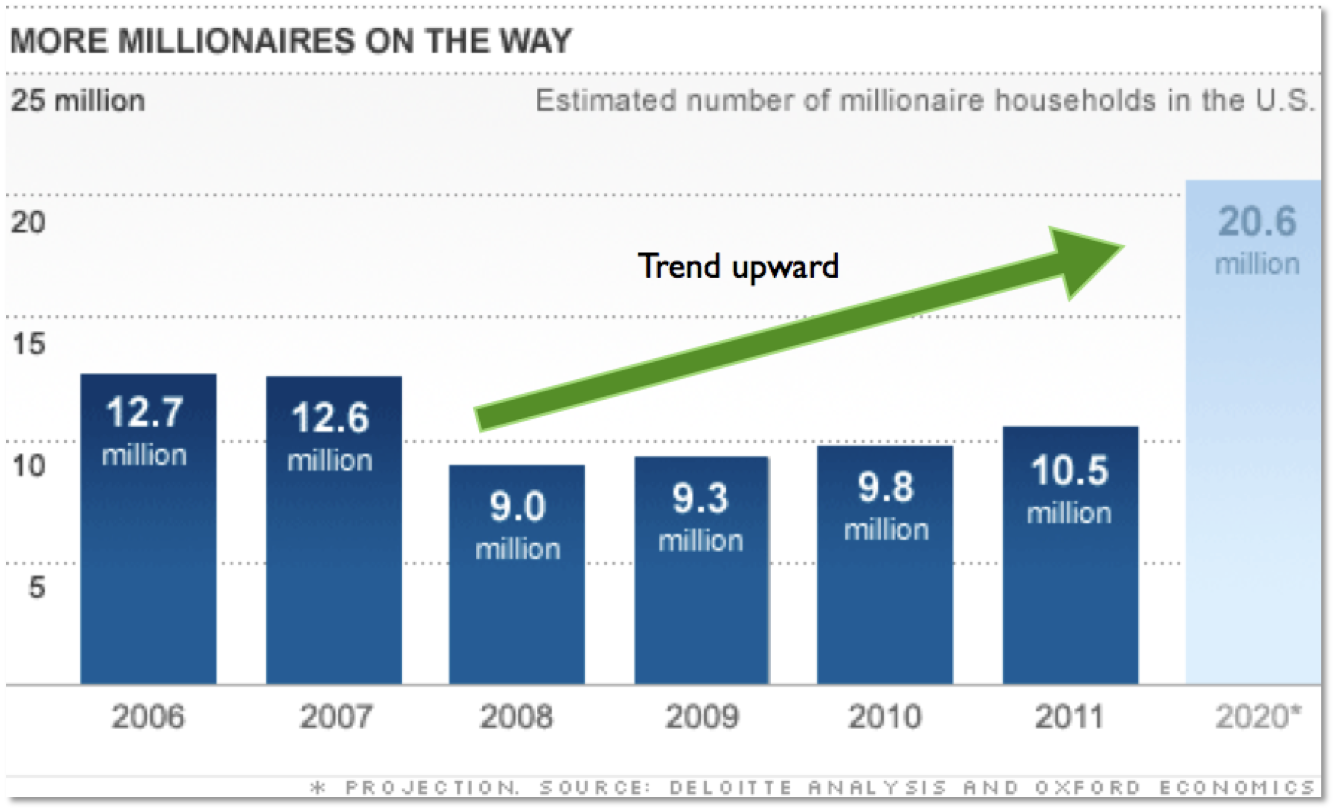

In the article, they share some research from a financial services company that is projecting the number of US millionaire households to double (yes, double!) in the next decade.

Check out this chart…

I shot a quick video to show you how the real estate market cycle is playing into this and how you can position yourself to be one of those “millionaires on the way.” I also ask you an important question that I want your feedback on.

Watch the video below…

As I mentioned, I put together a much more detailed video presentation walking you through the 4 market phases of the real estate cycle, where we’re at now, why this matters to you, and specifically how you can capitalize on the Phase 3 to 4 shift.

If I were you, I’d carve out some time over the next 48 hours to watch our “timing today’s market for success” video.

Alrighty, before you go, join the conversation below. Let me know how you’re positioning yourself with access to unconventional funds so that you can become one of the “millionaires on the way.” Thanks.

Happy Investing!

– Patrick

Hey Patrick,

I completely agree. With the senior citizen population unloading their assets we stand to be in just the right place in time to profit. I’m thinking that it’s a better time to hold assets then it is to flip. Unless it’s a screaming deal like a beach front home 😉 What are you thoughts?

Thanks!

-Jared

Yeah Jared, I think it’s a great time to buy and hold. The key is having access to long term private money (or other unconventional funds).

– Patrick

I think that this is so true. It’s soooo difficult to set up a company with assets protection and try to “get the deals” at the same time with your own money. I had to break down and borrow off my father (he’s 84 and I’m 41) to pay down some initial costs and hope to keep my credit to be able to move on with deals. Banks definitely do not open there wallets! I give my dad interest so there is some incentive for him too that is better than he’d get from any bank.

Hey Cathie,

Yeah banks are tough… unless you have really good credit and money to put down yourself. But even then, you can only get a few loans in your own name from traditional sources.

If I can help with anything, let me know.

– Patrick

Hay Pat,

What I am going to do is buy as many properties as I can get my hands on, rent for a passive income, cash out when the market caps, and then start the prosess all over again.

ED

Ps. I hate to say this Pat, but, you have gone from looking like a 12 year old, to a 12 year old with a gotee. LoL

Sounds like a plan Ed. Nice!

Haha… yep, I was blessed with a baby face. It’s working out for me now 🙂

– Patrick

Patrick,

It’s not enough just to position ourselves to become millionaires in this next growth phase of the 4 cycles of the real estate market. If we care at all about our families and our close friends, we’ll help them become millionaires too. That’s what I’m doing. I’ve organized almost my entire extended family and closest friends into a strategic mastermind support partnership where we’re all doing real estate investing together. We all support, encourage, reach out to and help each other and it’s making all the difference in the world! We now have this mindset that we’re going to the next level together!

To help us do that, one of the smartest things we’ve done is invest in your Private Money On Demand program. We just did a search of the mortgage records in our county going back over the last 4 months and have already located 118 private lenders. By the time we go back 12 full months, we expect to have a starting list of well over 300 potential private lenders right here in our own county that our family will begin carefully cultivating for our deals utilizing your program as our blueprint to make sure we stay SEC compliant in the process. Some of the lenders we have found have done as many as 5 mortgages just over the past 4 months. If we end up with even 10% of these lenders working with us, and then they start referring their friends and associates to us too, can you imagine the lending resources our family could eventually have to get deals done! Now that’s taking massive action!

Your training videos and your entire program are AWESOME and I have already referred many other investors to you and will continue to do so! When I along with my entire extended family and closest friends become millionaires together in this next growth phase of the 4 real estate cycles, one of the main reasons we will have arrived is the training and all the great help we’ve received from you and Charity helping us to grow and develop our base of private lenders!

Thanks, Pat and Charity!

Randy

Wow Randy! You’re welcome man.

Thanks so much for the kind words. Hearing that one of the smartest things you’ve done is invest in the Private Money On Demand program is awesome! Love it man.

We appreciate you taking action with the PMOD program. 118 private lenders so far. Nice!

Thank ya for the referrals. We’ll treat ’em like family.

Alright Randy, let’s do this. Time to get all the private money you want and need for your biz. Let us know if we can help with anything.

– Patrick

Hi Patrick,

I love to watch every details of all the information you shared but to tell you frankly I don’t know where to start because I’m a non US residence.Thanks a lot and hope to help me as a newbie on this kind of biz

Regards

Adrian